who pays sales tax when selling a car privately in ny

But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit. The average sales tax rate on vehicle purchases in the United States is around 487.

States That Allow Trade In Tax Credit

Sales or rentals of real property.

. The DMV calculates and collects the sales tax and issues a sales tax receipt. Once the buyer has the vehicle registered under his name he must pay to sell Texas. In such a sale the buyer must pay the required state tax on the transaction when he or she registers the car with the Department of Motor Vehicles.

Supplemental MCTD is 50. Lets say you purchase a new vehicle for 50000. The sale price of the vehicle.

While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. However if you bought it for 14000 and sold it for 15000 earning a 1000 capital gain you would report this on your tax return using Schedule D on Form 1040 thats appropriately titled. Register and title the vehicle or trailer.

Instead the buyer is responsible for paying any sale taxes. License plates and registrations buyers must visit a motor vehicle service center to register a vehicle for the first time. For example Idaho charges a 6 tax which means you multiply the cost of the car 37851 and multiply it by 006.

How Much is the Average Sales Tax Rate on Cars. The bill of sale must indicate whether the vehicle is new used reconstructed rebuilt salvage or originally not manufactured to US. If i sell my car do i pay taxes.

Sign a bill of sale even if it is a gift or. If you leased the vehicle see register a leased vehicle. Box 68597 Harrisburg PA 17106-8597.

Provide other acceptable proofs of ownership and transfer of ownership. You would not have to report this to the IRS. Calculate Car Sales Tax in New York Example.

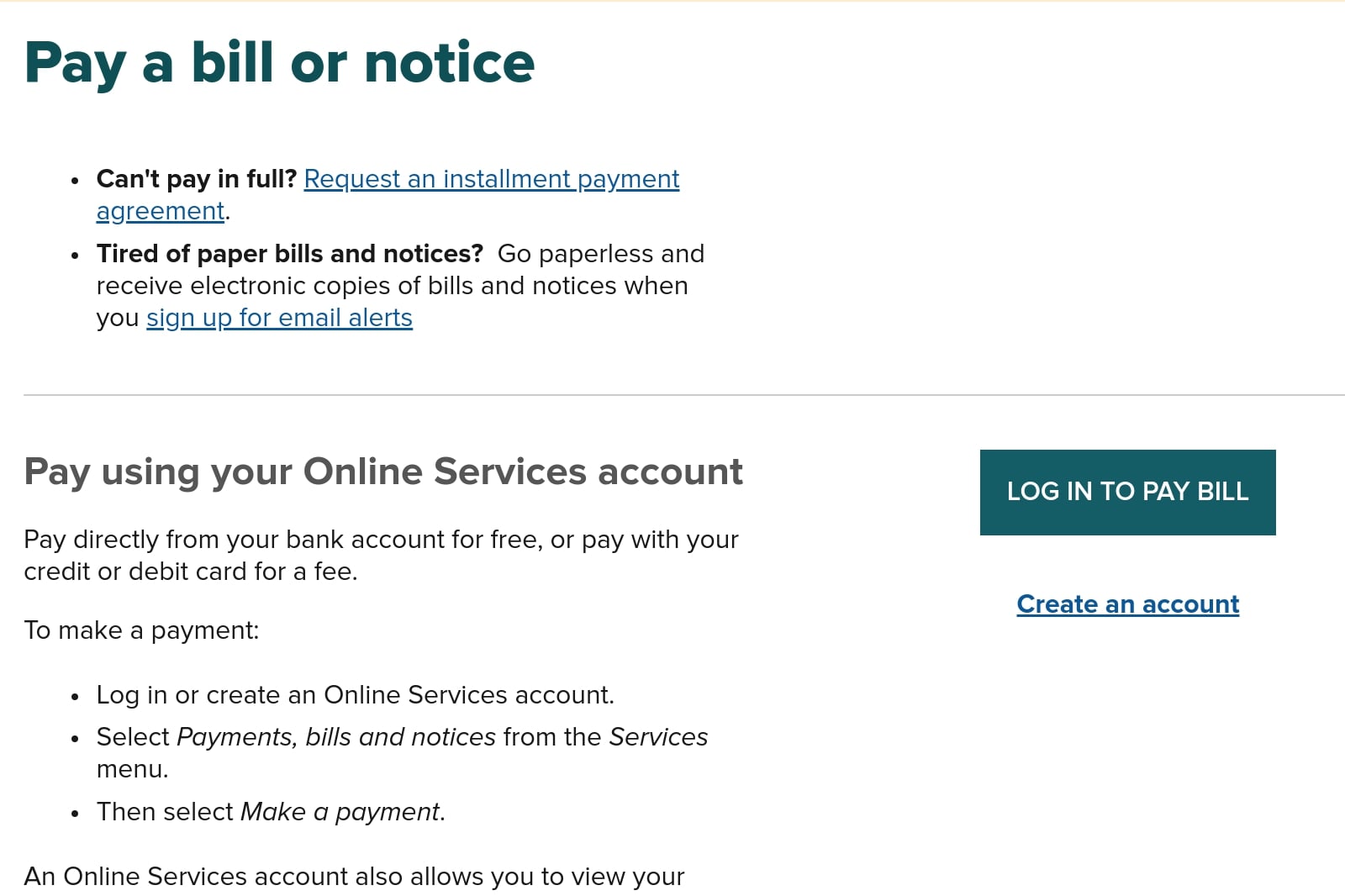

If the vehicle was a gift or was purchased from a family member use the Statement of Transaction Sales Tax Form pdf at NY State Department of Tax and Finance DTF-802 to receive a sales tax exemption. The DMV office collects the sales tax from the new owner if the new owner is required to pay any sales tax. To transfer ownership of an original New York State Certificate of Title the buyer must fill out the and sign the transfer section of the proof of ownership.

Sales of most food for home consumption. The seller must indicate the mileage of the vehicle in the appropriate spaces provided on the ownership document. If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership.

However in New York the taxable amount is 42500 rebate is taxed Now multiple 42500 by 4. However certain states have higher tax rates under certain conditions. That means Idaho charges a sales.

That puts your out-of-pocket cost at 40000. The dealer must reveal on the sales contract when a passenger car had been used primarily as a fleet car. The dealer must provide the buyer with odometer and salvage disclosure statements.

You should expect to pay a four percent sales tax and an additional local tax of at least four percent depending on your locale within the state. Who Pays Sales Tax When Selling A Car Privately In Florida Form 1181E Download Fillable PDF or Fill Online. According to the Internal Revenue Service the tax rate which is based on the net capital gain is usually no.

Sales of medical care. Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in. Register and title the vehicle or trailer or snowmobile boat moped or atv or transfer a registration from another vehicle.

Sales of prescription and nonprescription medicines. Check out the facts with IMPROV. So that means if you buy a used vehicle in the area you will pay a total of eight percent in sales taxOn the other hand if you were to buy the exact used car in New York City you should prepare to pay up to 888 percent sales tax.

Sign the bill of sale even if it is a gift pay sales tax or have proof of an exemption. In this case its 37851 x 006 227106. 247 Support 800 660-8908.

This gives you a state sales tax of. The license plate should be returned to PennDOT at Bureau of Motor Vehicles Return Tag Unit PO. The average total car sales tax paid in New York state is 7915.

Sales of most personal services see for exceptions in New York City. Private party sales within most states are not exempt from car tax but unlike dealer transactions the seller does not collect the car tax. Your trade-in vehicle is worth 7500 and you get a 2500 rebate.

Sales of educational services. For example Pleasantville New York currently has the lowest local sales tax rate of four percent. Gift or selling a car in New York is broken down in this article.

When a dealer sells a motor vehicle to a resident of New York State the dealer must collect sales tax from the customer unless the sale is. Publication 838 1212 Penalties for operating without a valid Certificate of. To apply see Tax Bulletin How to Register for New York State Sales Tax TB-ST-360.

If this happens youll pay short-term capital gains tax at your regular income tax rate on a car you owned for one year or less. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. This important information is crucial when youre selling.

So if you bought the car for 14000 and sold it for 8000 you would have a capitol loss of 6000. All you need to know to sell or gift a car in NY. Who pays sales tax when selling a car privately Uncategorized February 7 2021 Uncategorized February 7 2021.

That tax rate is 725 plus local tax. If you owned the car longer than a year youll pay long-term capital gains tax. Complete and sign the transfer ownership section of the title certificate and.

When a dealer sells a motor vehicle to a resident of New York State the dealer must collect sales tax from the customer unless the sale is exempt. The tax due in is called use tax rather than sales tax but the tax rate is the same. Among the common transactions that are not subject to the sales tax are the following.

In New York even if the vehicle is owned by two owners only one of the owners is required to sign the title in order to transfer ownership. However the scenario is different when you profit from the sale. The most expensive standard sales tax rate on car purchases in general is found in California.

Once the lienholder reports to flhsmv that the lien has been satisfied. After the title is transferred the seller must remove the license plate from the vehicle. If you buy another car from the dealer at the same time many states offer a trade-in tax exemption that lowers the amount of sales tax.

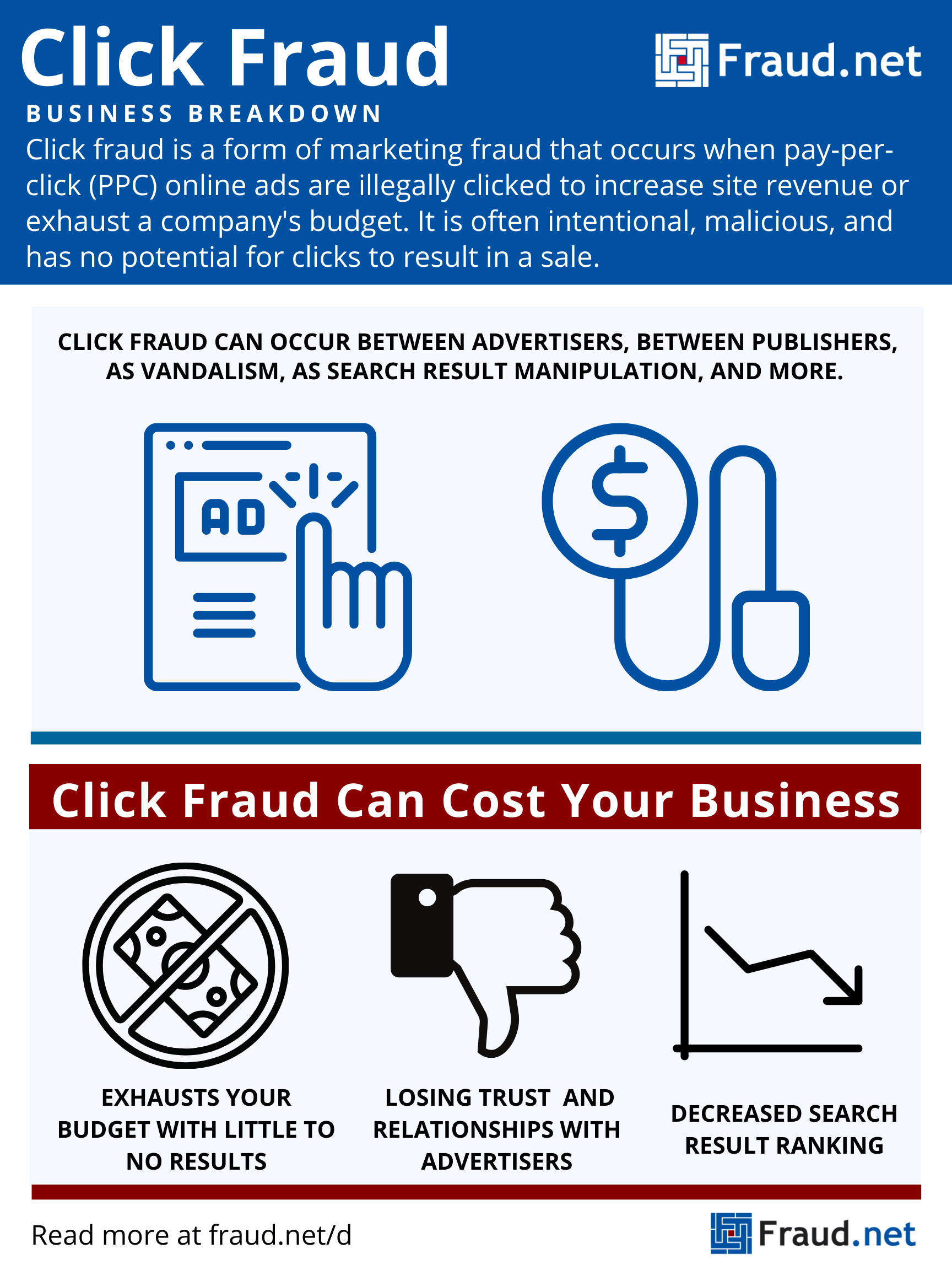

Fraud Definitions Archive Fraud Net

Sales Tax Ny Resident Purchasing Car In Ct R Tax

_(1).jpg)

Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos

Florida Car Sales Tax Everything You Need To Know

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-9096554281-5b4b5b6b46e0fb0037843703.jpg)

How To Handle Sales Taxes When You Sell Across State Lines

How To Sell A Car With A Lien Coverage Com

You Can Sell Your Leased Car For A Profit Here S How Much Yaa

Liability And Risks Of Selling Your Car Driveo

11 Best For Sale By Owner Websites 2022 Rankings Houzeo Blog

Using A Vehicle Bill Of Sale Legalzoom Com

Maryland Car Tax Everything You Need To Know

Nys Tax Lien Removal How To Take It Off Your Property And Credit Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

States That Allow Trade In Tax Credit

How To Sell A Car On Craigslist 5 Things To Know Credit Karma

Reports Of 10k To 20k Dealer Markups Now Common Due To Vehicle Shortage Your Options Torque News

Virginia Sales Tax On Cars Everything You Need To Know

You Can Sell Your Leased Car For A Profit Here S How Much Yaa